A mechanism defined by BIP300 that allows people to send money to specific sidechain "buckets" on the mainchain, and then block producers to vote over a long period of 3~6 months to authorize withdrawals back from that bucket. There is also an alternative, compatible proposal.

A mechanism that allows a sidechain to anchor itself on the Bitcoin chain (therefore not needing any proof-of-work of its own) while also pushing the sum of all its block fees into a single Bitcoin transaction that can be earned by Bitcoin block producers without them even knowing. It can be implemented using either this simple method that uses BIP118 or the more involved BIP301 method.

Drivechain is born.

Drivechain is the technique for the creation of decentralized 2-way peg sidechains for Bitcoin. These sidechains can be used to improve Bitcoin in every front, including privacy, scalability, decentralization and security, and also add many interesting features not possible before that can make the world better and continue the revolution started by Satoshi Nakamoto. Join us!

A list of some good candidates of things that can be enabled as sidechains once BIP300 is activated on Bitcoin.

Important people and what they think about Drivechain.

Visit the Releases page on drivechain.info or this directory.

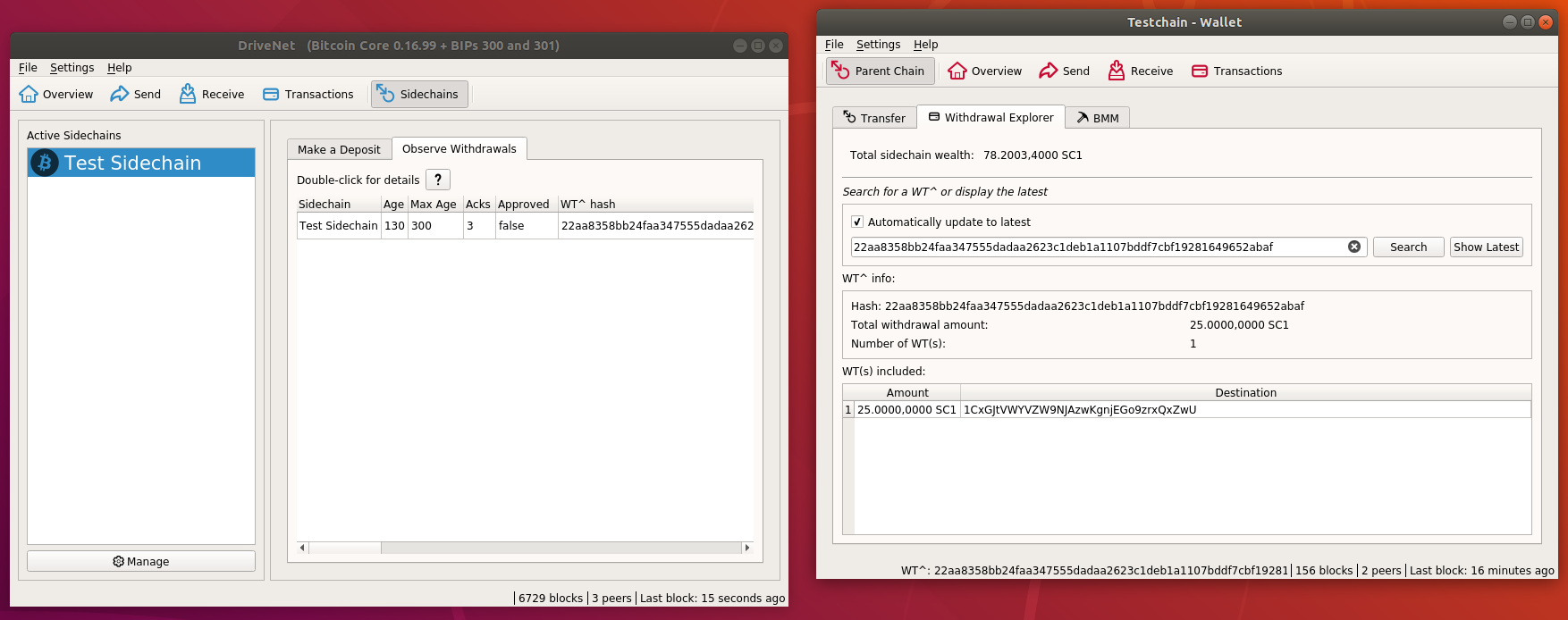

There is a video tutorial for using zSide and a Drivenet written tutorial with many screenshots and a tutorial specific for adding sidechains.

These are some of the common arguments voiced against Drivechain. They have been answered innumerable times and you can find the answers on the articles and videos listed above, but here are some quick answers again:

They are very unlikely to do because it's not a reasonable economic decision and it would hurt their businesses. Sidechains are likely to have a relatively high ratio of money being moved to money that is just parked, so it's likely to produce a lot of fees (that would then go to Bitcoin miners) for a small amount of coins in it. It will never be advisable for anyone to send their life-savings to a sidechain, so even in the case of a theft losses are likely to be minimal, much smaller than the losses people have had from running Lightning channels or buying shitcoins in the past, and the Bitcoin protocol has never prohibited these activities.

That is the security mechanism that prevents funds from being stolen by a simple majority. A minority of miners can also create chaos on the Bitcoin main chain by orphaning blocks and threatening the profits of the majority miners, but that would come with a huge cost, therefore it's not expected that they do it. The same rationale applies to keeping funds hostage.

Because of blind merge-mining Bitcoin miners just need to grab the sidechain block hash that is paying more fees on Bitcoin and include that, they don't have to care about MEV. If the sidechain has any MEV opportunities these are to be captured by sidechain block builders who will just translate them into fees for the Bitcoin miners.

In non-blind merge-mining there is indeed an added fixed cost for Bitcoin miners to keep up with the sidechain nodes, as it happens today with Namecoin, RSK, Stacks and others. That cost can be assumed to be negligible though, and it's something that already happens today. With blind merge-mining the cost falls to zero as Bitcoin miners can capture ~99% percent of the value created on sidechains without having to run a sidechain node or care about building its blocks.

If there are multiple sidechains and constant activity the fees coming from these sidechains are likely to not have huge bumps such that it makes more sense for everybody to go on and wait for the next sidechain block paying fees anyway.

There is no reason to believe that will happen. Bitcoin users do not have to care about what happens in the sidechains, regardless of what is the decision from miners: they can either decide one way or another, or just follow what most people running sidechain nodes decide.

They may be empty in the beginning but miners will still want to keep them until they get enough activity. If after a long time it has become clear that a specific sidechain is not being used it can be transitioned to another without users losing funds, or the funds can be returned in a final withdraw. Even if miners decide to pocket the funds, it's not as if people would have their life savings on this very new experimental sidechain anyway, they are likely to lose less on this than by running a Lightning node and getting tons of force-closes and uneconomical HTLCs.

No one can steal from them without getting >70% of the hashrate and going through the very long 6-month withdraw process, so it's not like a custodial exchange whose server can be invaded or whose owner can be kidnapped and coins stolen.